Cyprus Intellectual Property (IP) Tax Regime

Our Intellectual Property & IT Department is pleased to assist you. Please fill out the form below so that we can provide you with a quick and efficient service. We will connect you with a dedicated lawyer who has the skills necessary to assist you.

BACKGROUND

The Cyprus House of Representatives amended in October 2016 the Income Tax Law so that the current Cyprus IP tax legislation would be aligned with the provisions of Action 5 of the OECD’s Base Erosion and Profit Shifting (BEPS) project. Such amendments are to have retroactive application as from 1 July 2016.

The IP tax regime has been reviewed by the EU Code of Conduct and it is considered as fully compatible with EU standards.

BENEFITS OF THE CYPRUS IP TAX REGIME

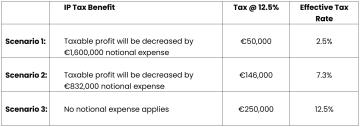

The Cyprus IP tax regime offers a tax benefit of up to 80% on profits qualifying for the regime, by way of notional expense deduction. With a corporate tax rate of 12.5%, this can result in an effective tax rate as low as 2.5%.

PROVISIONS OF THE CYPRUS IP TAX REGIME

The Cyprus IP tax regime complies with the provisions of the modified ‘nexus approach’, whereby for an intangible asset to qualify for the benefits of the IP tax regime, there needs to be a direct link between the qualifying income and the own qualifying expenses contributing to that income.

For the calculation of the qualifying profits the overall income (being the gross income derived from qualifying intangible assets minus any direct costs), the qualifying expenditure, uplift expenditure and overall expenditure are taken into consideration. The nexus approach is additive in that the calculation requires that expenditure includes all expenses incurred by the taxpayer over the life of the qualifying intangible asset.

In brief, an amount equal to 80% of the qualifying profits earned from qualifying intangible assets will be allowed as a tax-deductible expense for qualifying taxpayers.

A. Qualifying taxpayers

Qualifying taxpayer is a person who is resident of the Republic of Cyprus or permanent establishment in the Republic of Cyprus of a person who is not resident in the Republic of Cyprus or permanent establishment located outside the Republic of Cyprus which is subject to tax in the Republic of Cyprus.

B. Qualifying intangible assets

As per the Income Tax Law, “qualifying intangible asset” is defined as an asset which was acquired, developed or exploited by a person within the course of carrying out his business (with the exception of intellectual property related to marketing), which is the result of research and development (R&D) activities, and which includes intangible assets for which only economic ownership exists.

Qualifying intangible assets comprise of:

i. Patents, as defined in accordance with the provisions of Patent Law;

ii. computer software programs;

iii. other intangible assets which are legally protected and fall within one of the following categories:

- utility models, intellectual property assets which provide protection to plants and genetic material, orphan drug designations and extensions of protections for patents;

- non-obvious, useful and novel, where the person utilizing them in furtherance of a business does not generate gross revenues in excess of €7,500,000 per annum from all intangible assets (or a maximum of €50,000,000 turnover globally in case of a group of companies), which are certified as such by an appropriate authority, in Cyprus or abroad.

The definition of qualifying intangible assets specifically excludes the following:

- business/trade names, brands, trademarks, image rights and other intellectual property rights used for the marketing and sale of products and services.

C. The Nexus Fraction

The nexus fraction is used to determine the amount of qualifying profits that will give the relevant deduction to the qualifying taxpayer.

Qualifying Profit (QP)

Qualifying profit (QP) is defined as the proportion of the overall income (OI) derived from the qualifying asset, corresponding to the fraction of the qualifying expenditure (QE) plus the uplift expenditure (UE) over the overall expenditure (OE) incurred for the qualifying intangible asset.

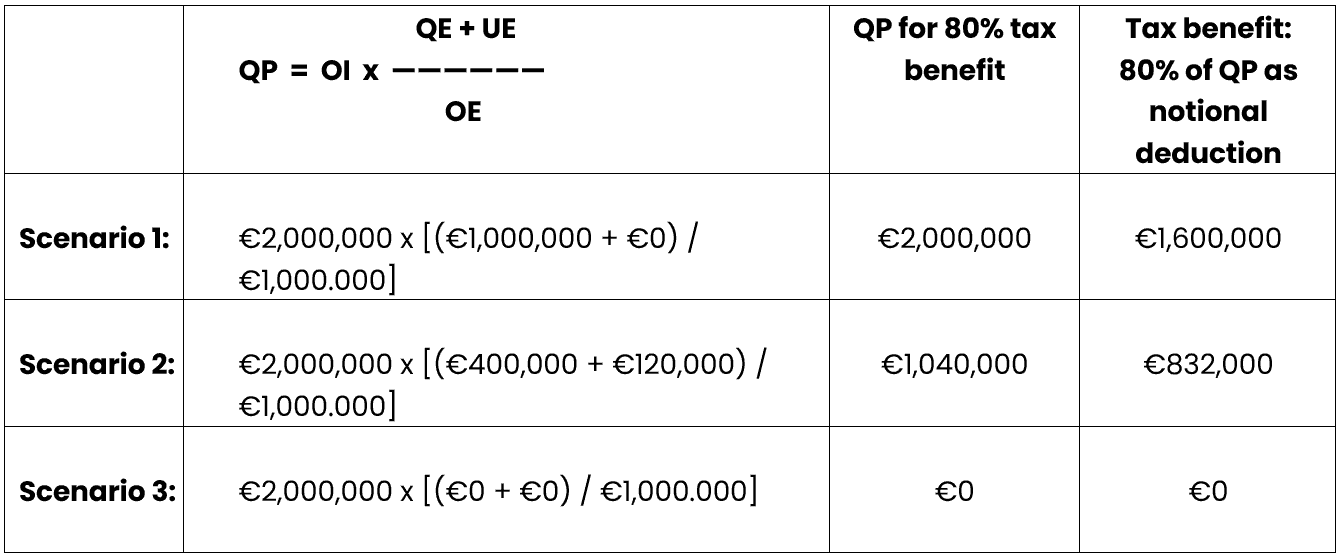

The amount of QP is derived by applying the following formula:

Where:

OI is the “overall income derived from the QA”

QE is the “qualifying expenditure on the QA”

UE is the “uplift expenditure on the QA” and

OE is the “overall expenditure on the QA”

Tax benefit:

For the purpose of calculating the taxable profit, 80% of the qualifying profit derived from qualifying intangible assets is treated as a deductible expense. For each tax year, the taxpayer may elect to waive this allowance, either in part or in whole.

By the same token, in case where a loss is incurred, only 20% of this loss can be surrendered to other group companies or be carried forward to subsequent years.

D. Explanation and breakdown of the relevant terms

Overall Income (OI)

Overall income is defined as the gross income earned from qualifying intangible assets during the tax year, reduced by any direct costs incurred for generating the income.

Overall income includes, but is not limited to:

- royalties or other amounts resulting from the use of qualifying intangible assets;

- license income for the operation of qualifying intangible assets;

- any amount received from insurance or as compensation in relation to qualifying intangible assets;

- income from the disposal of qualifying intangible assets, excluding profits of a capital nature;

- embedded income of qualifying intangible assets arising from the sale of products or services, or from the use of procedures that are directly related to the asset.

For the purpose of calculating overall income, direct costs include:

- all costs incurred, either directly or indirectly, wholly and exclusively for the purpose of earning the income from qualifying intangible assets;

- the amortization of the cost of the assets;

- notional interest on equity contributed to finance the development of the assets (being a notional interest tax deduction allowed by Cyprus tax provisions).

Capital gains arising from the disposal of a qualifying intangible asset are not included in the Overall Income and are fully exempt from tax.

Qualifying Expenditure (QE)

Qualifying expenditure for qualifying intangible assets is defined as the sum of all R&D costs incurred during any given tax year wholly and exclusively for the development, improvement or creation of qualifying intangible assets, and which costs are directly related to such assets.

Qualifying expenditure includes, but is not limited to:

- wages and salaries;

- direct costs;

- general expenses relating to installations used for R&D;

- commission expenses associated with R&D activities;

- costs associated with R&D that has been outsourced to non-related persons.

Qualifying expenditure does not include:

- costs for acquisition of intangible assets;

- interest paid or payable;

- acquisition costs or construction costs of immovable property;

- amounts paid or payable directly or indirectly to a related person to conduct R&D activities, regardless of whether such amounts relate to cost sharing agreements;

- costs which cannot be proved directly connected to a specific qualifying intangible asset.

Any expenditure for R&D that has been outsourced to non-related parties, as well as any expenses of a general nature for R&D which cannot be allocated to the qualifying expenditure of a specific qualifying intangible asset, can be apportioned pro rata to the qualifying intangible assets.

Uplift Expenditure (UE)

An uplift expenditure is added to the qualifying expenditure, which will be equal to the lower of:

- 30% of the qualifying expenditure; and

- the total cost of acquisition of the qualifying intangible assets, plus the cost of outsourcing to related parties of any R&D activities in relation to such qualifying intangible assets.

Overall Expenditure (OE)

Overall expenditure relating to qualified intangible assets is defined as the sum of:

- the qualifying expenditure; and

- the total cost of acquisition of the qualifying assets, plus the cost of outsourcing to related parties of any R&D activities in relation to these assets, incurred during any tax year.

E. Accounting records

Persons claiming benefits under the Cyprus IP tax regime are obliged to maintain proper books of account, as well as records of income and expenses for each intangible asset.

ILLUSTRATIVE EXAMPLES

Once the nexus fraction is calculated, this will be used to determine the deduction available for each qualifying intangible asset.

We have created below three (3) examples with figures illustrating how the 80% notional deduction available for the qualifying intangible asset under the Cyprus IP tax regime can be determined.

The variable factors in the examples are:

- whether the asset was internally developed or whether it was acquired, and

- whether subsequent R&D costs were outsourced to related parties or to third parties.

Three (3) Scenarios to be examined are as follows:

- The qualifying intangible asset was created/developed/improved internally, with R&D costs being undertaken by the company itself

- The qualifying intangible asset was acquired, with subsequent R&D costs for improvements of the asset being were outsourced to non-related parties

- The qualifying intangible asset was acquired, with subsequent R&D costs for improvements being outsourced to related parties

The figures used below are for illustrative purposes in order to present the three (3) hypothetical scenarios:

Applying the above figures to the formula for calculation of the qualifying profit (QP) and the tax benefit of up to 80% as a notional deduction, we have:

As a result, the IP tax benefit will be:

LOSSES FROM THE QUALIFYING INTANGIBLE ASSETS

Where the calculation of qualifying profits results in a loss, only 20% of the loss can be surrendered to other group companies or be carried forward to subsequent years.

Disposal of an intangible asset (IP)

When an IP is disposed, an accounting profit or accounting loss may arise.

If the disposal is considered to be a capital nature transaction, then such accounting profit/loss is tax exemptible in Cyprus.

If the disposal is considered as a trading nature transaction, then such accounting profit/loss is taxable in Cyprus.

Up to 31 December 2019, upon disposal of an IP, the taxpayer should prepare a balancing statement consisting of the tax written down value of the IP to identify any balancing addition, to be taxed or any balancing deduction to be given as tax allowance. “Tax Written Down Value” is the cost of the IP less accumulated capital allowances claimed.

As of 1 January 2020, taxpayers disposing an IP are no longer required to prepare a balancing statement. As a result, any gain on the disposal of an IP (capital nature) is not taxable and consequently any loss not tax allowable.

Non-qualifying assets for the Cyprus IP tax regime

The cost of IP (including any R&D capitalized), irrespective of whether it is qualifying asset or not (excluding goodwill, is eligible for tax amortization (capital allowances – tax depreciation) over the estimated useful life of the asset with a maximum of 20 years. Goodwill does not qualify for amortization.

The taxpayer has the option to claim part or zero capital allowances for a given year. Any unclaimed amount is distributed over the remaining useful life of the asset.

Please feel free to contact us for a free consultation if you have any question and to discuss how we can be of assistance to you.

DISCLAIMER:

PARIS MAVRONICHIS & CO LLC accept no duty of care or liability for any loss occasioned to any person acting or refraining from action as a result of any material in this publication.

The material contained herein is provided for informational purposes only and does not constitute legal advice nor is it a substitute for obtaining legal advice from an advocate. Each situation is unique, and you should not act or rely on any information contained herein without seeking the advice of an experienced advocate. PARIS MAVRONICHIS & CO LLC will be glad to assist you in this respect.

Share This:

Latest Insights

Influencers: Legal and Intellectual Property Considerations

Influencers Influencers have proven to be a staple marketing tool for brands seeking to expand their marketing reach in social media platforms, such as Facebook, Instagram, TikTok and SnapChat. Influencers